Authored by Lance Roberts via RealInvestmentAdvice.com,

In recent months, much debate has been about rising debt and increasing deficit levels in the U.S. For example, here is a recent headline from CNBC:

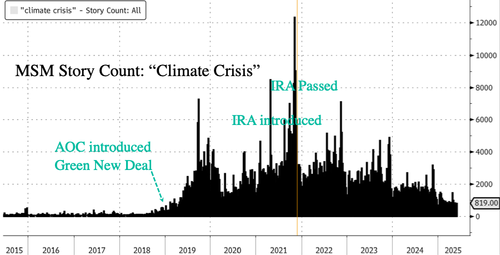

The article’s author suggests that U.S. federal deficits are ballooning, with spending surging due to the combined impact of tax cuts, expansive stimulus, and entitlement expenditures. Of course, with institutions like Yale, Wharton, and the CBO warning that this trend has pushed interest costs to new heights, now exceeding defense outlays, concerns about domestic solvency are rising. Even prominent figures in the media, from Larry Summers to Ray Dalio, argue that drastic action is urgently needed, otherwise another “financial crisis” is imminent.

The problem with Larry Summers’, Ray Dalio’s, and many others’ warnings of impending financial doom is that they have been warning of that very problem for decades. Such was the point of our previous discussion:

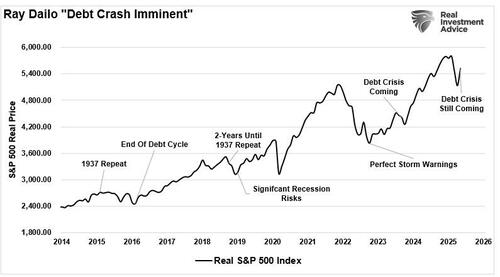

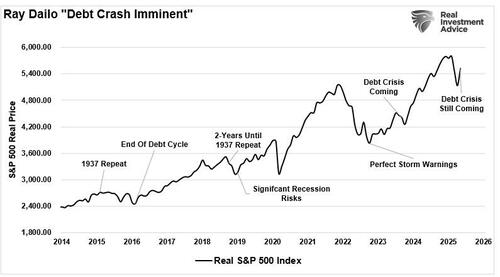

“It doesn’t take much to understand that Ray Dalio, a hedge fund titan, is like every other human being and is prone to error. I will not dismiss Dalio entirely, as his track record of managing money at Bridgewater is nothing to be scoffed at. However, his track record is far less enviable regarding debt crisis predictions. Here is a brief timeline.”

-

March 2015 – Hedge Funder Dalio Thinks the Fed Can Repeat 1937 All Over Again

-

January 2016 – The 75-Year Debt Supercycle Is Coming To An End

-

September 2018 – Ray Dalio Says The Economy Looks Like 1937 And A Downturn Is Coming In About Two Years

-

January 2019 – Ray Dalio Sees Significant Risk Of A US Recession

-

October 2022 – Dalio Warns Of Perfect Storm For The Economy (That was also the stock market low.)

-

September 2023 – Dalio Says The US Is Going To Have A Debt Crisis

But you can even go further back than these when he wrote about some of his biggest mistakes about a decade ago:

Here is the Problem for Investors

For investors who listened to Dalio’s predictions of a coming “depression” a decade ago, they missed participating in one of the most significant bull markets in U.S. history.

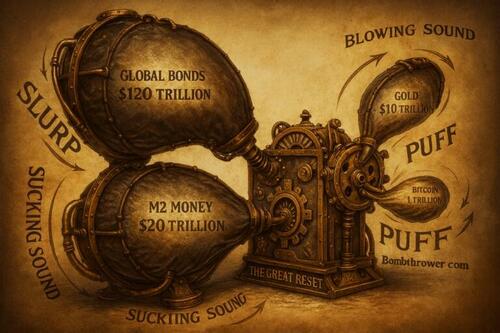

Yet over the past 40 years, the national debt has grown exponentially, with none of the dire consequences repeatedly predicted. Interest rates have fluctuated, political gridlock has persisted, and deficits have widened, but the U.S. economy continues to function, grow, and attract global capital. The reason is that the U.S. continues to enjoy what economists call the “exorbitant privilege” of being the issuer of the world’s reserve currency. Treasuries remain the deepest, most liquid capital market globally, and the dollar is central to global trade, investment, and reserves. This creates a structural advantage that allows the U.S. to run larger deficits than other nations without facing the same level of market discipline. So long as global trust in U.S. institutions and the rule of law remains intact, there is a deep and steady demand for U.S. debt, providing a long runway before any severe funding stress emerges.

Moreover, deficit spending is no longer a temporary tool used in times of crisis; it has become an embedded feature of the economy. Social Security, Medicare, defense, and other entitlements are politically sacrosanct. At the same time, fiscal transfers (like tax credits and subsidies) are now a regular part of household consumption and corporate support. In many ways, the U.S. economy is now structurally reliant on deficit-financed stimulus. Growth, consumer spending, and even corporate investment increasingly depend on a steady stream of government outlays.

While U.S. debt and deficit levels are elevated, there is no imminent risk of fiscal collapse. However, it is worth examining the impact of rising debt and deficit levels on future economic prosperity.

The Real Problem With Debts and Deficits

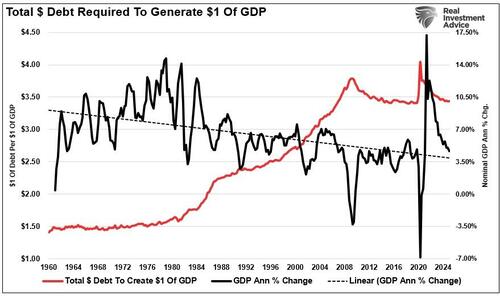

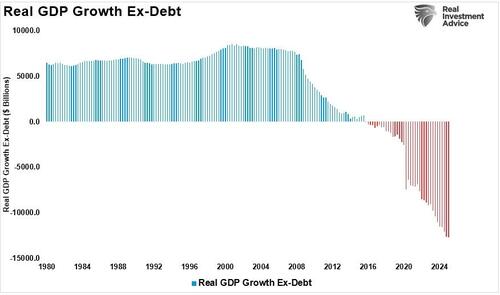

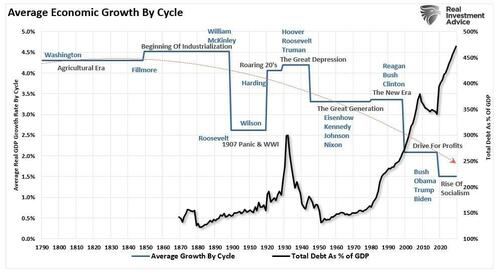

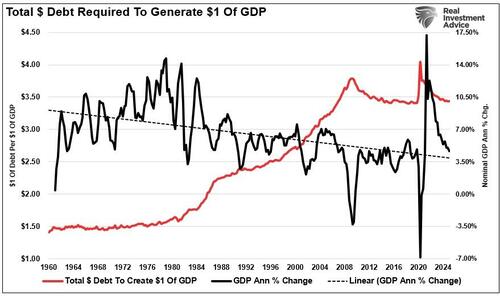

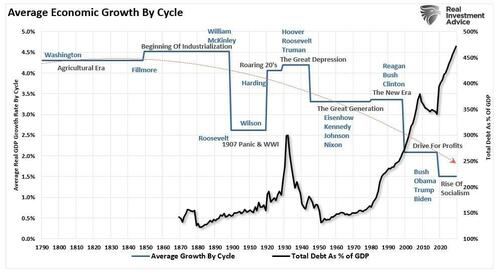

I understand the concerns about rising debt levels. However, the problem of rising debt levels for the U.S. is NOT a default but a continued degradation of economic growth. Let’s start this discussion with a basic fact—without continued increases in debt, there would be very little to no economic growth. This is because all government debt winds up in the economy and the household’s balance sheet through lending, credit, or direct payments. We can view this by looking at the dollars of debt required to create a dollar of economic growth. Since 1980, the increase in debt has usurped the entire economic growth. The problem with the growth in debt is that it diverts tax dollars away from productive investments into debt service and social welfare.

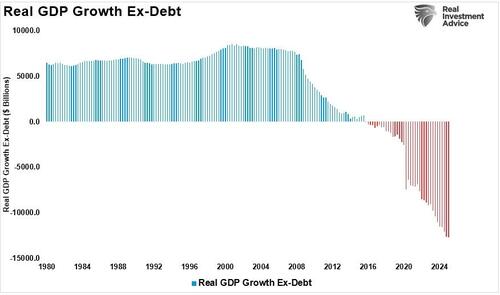

Another way to view this is to consider “debt-free” economic growth. In other words, without debt, there has been no organic economic growth since 2015. Thus, the debt and subsequent deficits must continue to expand to sustain economic growth.

The economic deficit has never been more significant. From 1952 to 1982, the economic surplus fostered an economic growth rate averaging roughly 8%. Today, that is no longer the case as the debt detracts from growth. Such is why the Federal Reserve has found itself in a “liquidity trap” where:

Interest rates MUST remain low, and debt MUST grow faster than the economy, just to keep the economy from stalling out.

The problem with the current issuance of debt is that it is primarily non-productive debt. That is a crucially important concept concerning debt issuance and its impact on economic growth.

Non-Productive Debt Is The Problem

Not all debt is created equal. The key distinction lies between productive and non-productive debt, and understanding the difference is critical to evaluating the risks and benefits of government borrowing.

Productive debt refers to borrowing used for investments that generate long-term economic returns, such as infrastructure, education, research, or business capital expenditures. These types of investments can increase future GDP, improve productivity, and ultimately pay for themselves through higher tax revenues.

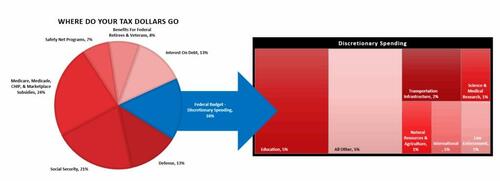

In contrast, non-productive debt funds consumption or transfers that do not yield a measurable economic return. In the U.S., social welfare and interest payments on existing debt are a large majority of Government expenditures.

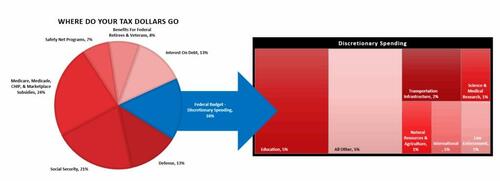

The data below shows that of every dollar spent by the Federal Government, roughly 73% is “mandatory” spending on social welfare and interest expense.

While the non-productive spending is necessary, primarily to support vulnerable populations, it adds to the debt burden without expanding the economy’s capacity to grow. The U.S., like many developed economies, increasingly relies on non-productive debt to sustain economic momentum, which raises concerns about long-term fiscal sustainability. The danger isn’t the debt itself; it’s when borrowed funds fail to create future value, leaving future taxpayers with the bill and no corresponding economic benefit.

Dr. Woody Brock’s book “American Gridlock” best explains the difference between productive and non-productive debt.

“The word “deficit” has no real meaning. Take a look at the following example:

Country A spends $4 Trillion with receipts of $3 Trillion. This leaves Country A with a $1 Trillion deficit. In order to make up the difference between the spending and the income, the Treasury must issue $1 Trillion in new debt. That new debt is used to cover the excess expenditures, but generates no income leaving a future hole that must be filled.

Country B spends $4 Trillion and receives $3 Trillion income. However, the $1 Trillion of excess, which was financed by debt, was invested into projects, infrastructure, that produced a positive rate of return. There is no deficit as the rate of return on the investment funds the “deficit” over time.

There is no disagreement about the need for government spending. The disagreement is with the abuse, and waste, of it.”

Currently, the U.S. is Country A. Increases in the national debt have long been squandered on increases in social welfare programs and, ultimately, higher debt service, which has an effective negative return on investment. Therefore, the larger the debt balance, the more economically destructive it is by diverting increasing amounts of dollars from productive assets to debt service.

But here is where the most essential concept to understand comes into play.

A Negative Multiplier

Excess “debt” has a zero-to-negative multiplier effect, as Economists Jones and De Rugy showed in a study by the Mercatus Center at George Mason University.

“The multiplier looks at the return in economic output when the government spends a dollar. If the multiplier is above one, it means that government spending draws in the private sector and generates more private consumer spending, private investment, and exports to foreign countries. If the multiplier is below one, the government spending crowds out the private sector, hence reducing it all.

The evidence suggests that government purchases probably reduce the size of the private sector as they increase the size of the government sector. On net, incomes grow, but privately produced incomes shrink.”

Personal consumption expenditures and business investment are vital inputs into the economic equation. As such, we should not ignore the reduction of privately produced incomes. Furthermore, according to the best available evidence, the study found:

“There are no realistic scenarios where the short-term benefit of stimulus is so large that the government spending pays for itself. In fact, the positive impact is small, and much smaller than economic textbooks suggest.”

Politicians spend money based on political ideologies rather than sound economic policy. Therefore, the findings should not surprise you. The conclusion of the study is most telling.

“If you think that the Federal Reserve’s current monetary policy is reasonably competent, then you actually shouldn’t expect the fiscal boost from all that spending to be large. In fact, it could be close to zero.

This is, of course, all before taking future taxes into account. When economists like Robert Barro and Charles Redlick studied the multiplier, they found once you account for future taxes required to pay for the spending, the multiplier could be negative.”

What should not surprise you is that non-productive debt does not create economic growth. As Stuart Sparks of Deutsche Bank noted previously:

“History teaches us that although investments in productive capacity can in principle raise potential growth and r* in such a way that the debt incurred to finance fiscal stimulus is paid down over time (r-g<0), it turns out that there is little evidence that it has ever been achieved in the past.

Rising federal debt as a percentage of GDP has historically been associated with declines in estimates of r* – the need to save to service debt depresses potential growth. The broad point is that aggressive spending is necessary, but not sufficient. Spending must be designed to raise productive capacity, potential growth, and r*. Absent true investment, public spending can lower r*, passively tightening for a fixed monetary stance.”

This is why the economic drag from a debt reduction would be devastating. The last time such a reversion occurred was during the Great Depression.

Conclusion

This is one of the primary reasons why economic growth will continue to run at lower levels. Reversing non-productive spending is impossible due to the general population’s vast dependence on those programs. Reducing that spending would be “economic suicide.”

However, as noted in “Deficits May Find Their Cure In A.I.”

“From the deficit narrative perspective, this all suggests that the future is potentially much brighter than most imagine. The infrastructure buildout for AI data factories can drive economic growth by creating jobs, stimulating industries, and enabling AI-driven productivity gains. As noted above, increasing growth only marginally would stabilize the current debt-to-GDP ratio. However, boosting GDP growth to 2.3%- 3% annually would vastly improve outcomes. Furthermore, if interest rates drop by just 1%, this could reduce spending by $500 billion annually, helping to ease fiscal pressures.”

While the U.S. faces a daunting fiscal outlook marked by rising debt and expanding deficits, the genuine concern is not an imminent crisis or default. Instead, the deeper, more structural issue is that an increasing share of federal borrowing is funneled into programs that support consumption but fail to generate future economic returns. That shift, which began over 50 years ago, creates a long-term drag on economic growth, crowds out private investment, and lowers the economy’s potential, or r*.

As the data and history show, debt to fund productive assets, like infrastructure, innovation, and education, can sustain growth and even pay for itself over time. But borrowing for entitlements and debt service does not. Unfortunately, the political and demographic realities make it nearly impossible to reverse course without severe economic fallout. Unless policymakers redirect fiscal priorities toward investment in productive capacity, the economy will remain trapped in a cycle of low growth, rising obligations, and declining returns. Innovation may offer a way out, particularly the AI-driven transformation. If leveraged wisely, with targeted investment and smart policy, AI could lift productivity, restore growth, and ease the fiscal strain.

The path forward is narrow, but not closed, and not one of imminent financial crisis. However, the real challenge will be political will.

For more in-depth analysis and actionable investment strategies, visit RealInvestmentAdvice.com. Stay ahead of the markets with expert insights tailored to help you achieve your financial goals.