Hegseth says strikes are to destroy Iran's missile system, navy and end nuclear program

Mar. 2nd, 2026 01:45 pmWatch Live: Defense Secretary Hegseth speaks at Pentagon on Iran operation

Mar. 2nd, 2026 01:15 pmUS military says 4th service member killed in Iran war

Mar. 2nd, 2026 01:15 pmСлои итальянской реальности

Mar. 2nd, 2026 03:07 pmПо нашим ощущениям, Венеция вела себя совсем не так. Хотя, конечно, плохое заведение можно где угодно найти, если в неправильный слой реальности провалился. А дядька, торгующий носками и футболками на уличном рынке (в почти самом центре), охотно отдал купленную, но забытую прямо на месте футболку спустя почти целый день. Зато примерно таким боком, как она пишет, к нам повернулась Флоренция.

В общем, разные места к разным людям могут поворачиваться разными сторонами.

( Я тут до старых фоток добрался )

It is only day three of 'Operation Epic Fury' and Americans are waking up to shocking images of US fighter jets going down over Kuwait, and the incredibly rare scene of pilots parachuting down with a look of disbelief and confusion...

Kuwait's defense ministry says "several" US military aircraft have crashed https://t.co/Tvaq4zFrEY pic.twitter.com/SLaSYWwZep

— CNN (@CNN) March 2, 2026

US CENTCOM has confirmed, following a Kuwaiti government statement, "At 11:03 p.m. ET, March 1, three U.S. F-15E Strike Eagles flying in support of Operation Epic Fury went down over Kuwait due to an apparent friendly fire incident."

That's three US warplanes in apparently one incident. How does that happen? Of course, given the already thick fog of war and propaganda narratives fast going back and forth, it's entirely possible they could have been shot down by Iranian defenses or jets from just across the border. Iran is saying it has shot down at least one US F-15 fighter jet:

IRAN SAYS IT SHOT DOWN US F-15 FIGHTER JET: TASNIM

Here's the fuller CENTCOM narrative:

CENTCOM: “During active combat—that included attacks from Iranian aircraft, ballistic missiles, and drones — the U.S. Air Force fighter jets were mistakenly shot down by Kuwaiti air defenses. All six aircrew ejected safely, have been safely recovered, and are in stable condition. Kuwait has acknowledged this incident, and we are grateful for the efforts of the Kuwaiti defense forces and their support in this ongoing operation.”

Given there's now an official Pentagon casualty/death count, and given the fact that the Gulf allies and especially Israel are getting hit hard by Iran's significant ballistic missile arsenal, President Trump himself may now be (only too late) realize he just bit off more than he can chew in ordering this ultra-risky regime change operation.

There's as yet no clear endgame. Trump has talked about reaching objectives - without defining them, in something eerily (and predictably!) familiar with the 2003 Iraq war under Bush and the Neocons. Recall too that Trump just told The Atlantic magazine on Sunday morning that Tehran wanted to speak to him while feeling the pressure of the bombs falling, and that he was willing to do so. "They want to talk, and I have agreed to talk, so I will be talking to them," he said from his residence in Florida.

US military confirms “several” U.S. fighter jets have crashed over Kuwait, no proper explanations offered. Trump warned that US casualties could get “quite a bit higher.”https://t.co/SIlLArz8RN pic.twitter.com/1VpfpaY5mQ

— tim anderson (@timand2037) March 2, 2026

But soon after it became clear that's not happening - the Iranian genie is out of the bottle ...or we could say Pandora's Box Persian-style, which could make even Iraq look like a cakewalk. Adding insult to injury is that this is everything Trump and his team campaigned against.

Trump has already pivoted to saying the conflict looks to take up to four weeks (will it take years as Iraq did? nobody knows). Below is the man that was tapped by the slain Ayatollah Khamenei to run the day to day in his stead:

Israel is taking significant casualties, especially after Sunday's direct large Iranian warhead impact on a town near Jerusalem which left at least 9 dead and dozens wounded. Hezbollah has entered the war and in response Israel is once again pounding southern Lebanon and Beirut. Major international airports in the Gulf, particularly in the UAE, have bit hit by missiles and drones - also as US bases across the Gulf continue to be targeted. Even British-US bases on Cyprus have come under drone attack.

Gulf nations are seeing casualties, and even other European bases in the region have come under fire. American bases in northern Iraq have also been heavily targeted in Iran's retaliation waves. These have been sustained, particularly on Israel. One question which we've been covering remains: which side will have the missile and firepower arsenal to outlast the other? ...as the costs will soon enter the billions. Most importantly, as of Monday morning CENTCOM has newly confirmed four American troops killed in the operation.

Needless to say, if Trump's thinking really approached this as if it was 'one and done' Venezuela, and that after some quick salvo a country of 90 million with a well-armed and experienced military would immediately shout 'uncle!' - he's probably already realizing the situation is spiraling out of control far beyond his expectation. But he was clearly and loudly warned.

In Washington right now, the biggest story centers on headlines of "paranoia" and deep "anxiety" at the Pentagon in in national security council ranks:

Pentagon officials are worried about Donald Trump’s Iran strikes spiraling out of control if they stick to his timeline.

While the president boasts that the strikes could continue for several more weeks, military leaders are sounding the alarm behind the scenes about U.S. air defense stockpiles running out if the fighting goes on that long. “The mood here is intense and paranoid,” one insider told The Washington Post.

It seems the Pentagon is already throwing the White House and Trump under the bus, or is at least doing so through 'anonymous' quotes given to WaPo, NYT, CNN and others:

Pentagon briefers acknowledged to congressional staff in a briefing Sunday that Iran was not planning to strike US forces or bases in the Middle East unless Israel attacked Iran first, undercutting the administration’s argument Saturday that Tehran was planning to potentially strike the US preemptively and posed an imminent threat, according to multiple people who attended the briefing.

Senior administration officials told reporters Saturday that the US chose to attack Iran because it had received indications the regime was planning to launch missile attacks against US bases in the region preemptively and create a mass casualty situation. CNN reported Saturday that sources said there was no intelligence to support the administration’s claim.

And after all, Iran's economy was already brought to its knees through years of crippling sanctions, and the Iranians appeared to come hat in hand to the negotiating table in Geneva.

⚡️Carpet bombing in Tehran pic.twitter.com/PKqW3jUhK8

— War Monitor (@WarMonitors) March 2, 2026

To recount the warning late last month issued by no less than the chairman of the Joint Chiefs of Staff Gen. Dan Caine - the issues already facing American forces were clearly outlined and predicted. According to out prior paraphrase and outline of what's being freshly reported by WSJ:

1) Caine warned that the war plans under consideration carry a high risk of significant American and allied casualties.

2) He cautioned that a multi-day campaign would exhaust air-defense munitions and other limited-supply items, which are critical for protecting regional partners like Israel if Iran retaliates.

3) An intensive operation against Iran could deplete stockpiles to a level that would complicate U.S. readiness for a potential future conflict with China.

4) He described the potential campaign as one that could "stretch the military thin" and leave forces "overtaxed".

5) Caine's gave "high likelihood of success" reassurances before the January 2026 mission to apprehend Nicolas Maduro, he has been unable to provide similar guarantees regarding a large-scale strike on Iran.

⚡️🇮🇷🇮🇱JUST IN:

— Suppressed News. (@SuppressedNws) June 15, 2025

Clear footage showing hypersonic missile from Iran striking a target in Gush Dan and making massive impact in central Israel [Sound on]. pic.twitter.com/wrxBvfvhUx

Below is a review of the mounting casualties across the region from Operation Epic Fury. The US has so far issued an official count of four US troops killed and five others seriously wounded. That could already be significantly higher, unfortunately - along with the below numbers which are expected to climb:

-

Iran: At least 555 people have died since joint US-Israeli strikes began, according to the Red Crescent Society. Iranian state media reported that 168 students were killed in an airstrike on a girls’ elementary school, with three more students killed in separate attacks in Tehran and northern Iran. China’s foreign ministry confirmed that one Chinese national was also killed.

-

Lebanon: Israeli airstrikes on southern Lebanon and Beirut have killed at least 31 people, the Lebanese Ministry of Public Health said.

-

Israel: At least 10 people have been killed and more than 200 wounded since Israel launched operations against Iran, according to Magen David Adom. Nine of the dead were in Beit Shemesh, where a missile struck a bomb shelter.

-

Iraq: A US-Israeli strike hit a headquarters of Iraq’s Iran-aligned Popular Mobilization Forces, killing four members, the group’s Media Directorate said.

-

United Arab Emirates: Iran’s retaliatory strikes killed three people in the UAE, the defense ministry said. The victims—nationals of Pakistan, Nepal, and Bangladesh—were killed after Iranian drones penetrated the country’s air defenses.

-

Kuwait: Three US service members were killed in a suspected drone attack early Sunday, according to sources familiar with the incident. Separately, Kuwait’s health ministry reported one fatality from Iranian strikes.

-

Bahrain: One person died after debris from an intercepted missile ignited a fire aboard a “foreign vessel” in Salman Industrial City, according to Bahraini state media.

War spreads to Israel-Hezbollah theatre in Lebanon:

Lebanon is now being attacked by Israel, and Hezbolllah appears to have joined the fight. This war is quickly spreading, and the assumption of escalation control is a dangerous delusion pic.twitter.com/1T54LJdRsc

— Glenn Diesen (@Glenn_Diesen) March 2, 2026

To again cite, Glenn Greenwald, who summarized best how we got where we are: "For decades, Israeli Prime Minister Benjamin Netanyahu and American neoconservatives have dreamed of only one foreign policy goal: having the United States fight a regime-change war against Iran. With the Oval Office occupied by Donald Trump — who campaigned for a full decade on a vow to end regime-change wars and vanquish neoconservatism — their goal has finally been realized."

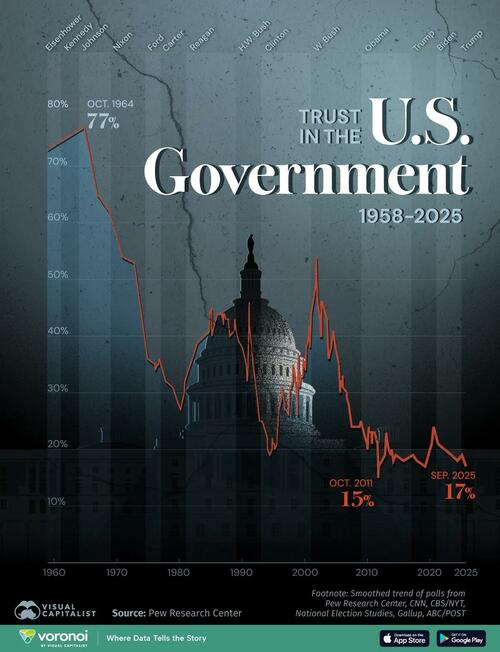

Trust In The US Government Has Plunged From 77% To 17%

Mar. 2nd, 2026 12:20 pmOver the past seven decades, Americans’ trust in the federal government has dropped from postwar highs to historic lows.

In 1964, 77% said they trusted Washington to do what is right most of the time.

As of September 2025, that figure stands at just 17%.

The chart below, via Visual Capitalist's Niccolo Conte, tracks this long-term shift, using data from Pew Research Center.

While trust has occasionally surged during moments of national crisis, the broader trajectory shows a steady erosion across generations.

From Postwar Highs to Vietnam-Era Decline

Trust peaked in 1964, when 77% of Americans said they trusted the federal government most of the time. Even in 1958, nearly three-quarters of the public expressed confidence in the federal government.

That began to change in the late 1960s and early 1970s. By 1970, trust had fallen to 54%, and it slipped further to 36% by 1974 in the aftermath of Watergate.

The Vietnam War, political scandals, and economic turbulence reshaped public opinion for decades to come.

| Date | Trust the government (%) |

|---|---|

| 9/28/2025 | 17 |

| 2/9/2025 | 19 |

| 5/19/2024 | 18 |

| 6/11/2023 | 19 |

| 05/01/2022 | 20 |

| 4/11/2021 | 21 |

| 8/2/2020 | 24 |

| 4/12/2020 | 21 |

| 3/25/2019 | 17 |

| 12/04/2017 | 18 |

| 4/11/2017 | 19 |

| 10/04/2015 | 18 |

| 7/20/2014 | 19 |

| 2/26/2014 | 18 |

| 11/15/2013 | 20 |

| 10/13/2013 | 19 |

| 5/31/2013 | 20 |

| 02/06/2013 | 22 |

| 1/13/2013 | 23 |

| 10/31/2012 | 19 |

| 10/19/2011 | 17 |

| 10/04/2011 | 15 |

| 9/23/2011 | 18 |

| 8/21/2011 | 21 |

| 2/28/2011 | 23 |

| 10/21/2010 | 23 |

| 10/01/2010 | 21 |

| 09/06/2010 | 23 |

| 09/01/2010 | 23 |

| 04/05/2010 | 23 |

| 04/05/2010 | 22 |

| 3/21/2010 | 24 |

| 2/12/2010 | 22 |

| 02/05/2010 | 21 |

| 1/10/2010 | 20 |

| 12/20/2009 | 21 |

| 8/31/2009 | 22 |

| 6/12/2009 | 23 |

| 12/21/2008 | 25 |

| 10/15/2008 | 24 |

| 10/13/2008 | 24 |

| 07/09/2007 | 24 |

| 01/09/2007 | 28 |

| 10/08/2006 | 29 |

| 9/15/2006 | 30 |

| 02/05/2006 | 31 |

| 1/20/2006 | 33 |

| 01/06/2006 | 32 |

| 12/02/2005 | 32 |

| 9/11/2005 | 31 |

| 09/09/2005 | 30 |

| 6/19/2005 | 35 |

| 10/15/2004 | 39 |

| 7/15/2004 | 41 |

| 3/21/2004 | 38 |

| 10/26/2003 | 36 |

| 7/27/2003 | 43 |

| 10/15/2002 | 46 |

| 09/04/2002 | 46 |

| 09/02/2002 | 40 |

| 7/13/2002 | 40 |

| 6/17/2002 | 43 |

| 1/24/2002 | 46 |

| 12/07/2001 | 49 |

| 10/25/2001 | 54 |

| 10/06/2001 | 49 |

| 1/17/2001 | 44 |

| 10/31/2000 | 38 |

| 10/15/2000 | 42 |

| 07/09/2000 | 39 |

| 04/02/2000 | 38 |

| 2/14/2000 | 34 |

| 10/03/1999 | 36 |

| 9/14/1999 | 33 |

| 5/16/1999 | 33 |

| 2/21/1999 | 31 |

| 2/12/1999 | 32 |

| 02/04/1999 | 34 |

| 1/10/1999 | 34 |

| 01/03/1999 | 37 |

| 12/01/1998 | 33 |

| 11/15/1998 | 30 |

| 11/01/1998 | 26 |

| 10/26/1998 | 28 |

| 8/10/1998 | 31 |

| 2/22/1998 | 35 |

| 02/01/1998 | 33 |

| 1/25/1998 | 32 |

| 1/19/1998 | 32 |

| 10/31/1997 | 31 |

| 8/27/1997 | 31 |

| 06/01/1997 | 26 |

| 1/14/1997 | 27 |

| 11/02/1996 | 27 |

| 10/15/1996 | 28 |

| 5/12/1996 | 31 |

| 05/06/1996 | 29 |

| 11/19/1995 | 27 |

| 08/07/1995 | 22 |

| 08/05/1995 | 21 |

| 3/19/1995 | 20 |

| 2/22/1995 | 21 |

| 12/01/1994 | 21 |

| 10/29/1994 | 22 |

| 10/23/1994 | 20 |

| 06/06/1994 | 19 |

| 1/30/1994 | 20 |

| 1/20/1994 | 22 |

| 3/24/1993 | 25 |

| 1/17/1993 | 25 |

| 1/14/1993 | 25 |

| 10/23/1992 | 25 |

| 10/15/1992 | 25 |

| 06/08/1992 | 29 |

| 10/20/1991 | 35 |

| 03/06/1991 | 42 |

| 03/01/1991 | 46 |

| 1/27/1991 | 40 |

| 12/01/1990 | 33 |

| 10/28/1990 | 32 |

| 09/06/1990 | 35 |

| 1/16/1990 | 38 |

| 6/29/1989 | 39 |

| 1/15/1989 | 41 |

| 11/10/1988 | 43 |

| 10/15/1988 | 41 |

| 1/23/1988 | 40 |

| 10/18/1987 | 43 |

| 06/01/1987 | 43 |

| 03/01/1987 | 44 |

| 1/21/1987 | 43 |

| 1/19/1987 | 42 |

| 12/01/1986 | 44 |

| 11/30/1986 | 43 |

| 09/09/1986 | 44 |

| 1/19/1986 | 44 |

| 11/06/1985 | 43 |

| 7/29/1985 | 42 |

| 3/21/1985 | 40 |

| 2/27/1985 | 42 |

| 2/22/1985 | 45 |

| 11/14/1984 | 44 |

| 10/15/1984 | 41 |

| 12/01/1982 | 39 |

| 11/07/1980 | 32 |

| 10/15/1980 | 30 |

| 3/12/1980 | 27 |

| 11/03/1979 | 28 |

| 12/01/1978 | 31 |

| 10/23/1977 | 32 |

| 4/25/1977 | 34 |

| 10/15/1976 | 36 |

| 09/05/1976 | 35 |

| 6/15/1976 | 35 |

| 03/01/1976 | 34 |

| 02/08/1976 | 35 |

| 12/01/1974 | 36 |

| 10/15/1972 | 53 |

| 12/01/1970 | 54 |

| 10/15/1968 | 62 |

| 12/01/1966 | 65 |

| 10/15/1964 | 77 |

| 12/01/1958 | 73 |

Temporary Surges During National Crises

Although the long-term trend is downward, trust has occasionally rebounded during moments of national unity. After the 9/11 attacks, trust jumped from 44% to 54% in a matter of months. It was one of the last times a majority expressed confidence in Washington.

Similar, though smaller, increases occurred during other crises. In early 2020, trust briefly rose to 24% amid the COVID-19 outbreak. However, these bumps have proven short-lived, with trust quickly returning to lower levels.

A New Era of Persistent Low Trust

Since the mid-2000s, trust in government has rarely crossed the 30% mark. In the 2010s and early 2020s, it often dipped below 20%.

As of September 2025, just 17% of Americans say they trust the federal government most of the time — near the lowest level recorded in Pew’s time series.

If you enjoyed today’s post, check out America’s Growing Mountain of Debt on Voronoi, the new app from Visual Capitalist.

The UK's New Grooming Gang Scandal

Mar. 2nd, 2026 11:50 amAuthored by Fraser Myers via The American Conservative,

In borderless Britain, it seems as if barely a day goes by without some monstrosity being committed by a migrant who should never have been in the country in the first place. The world is now familiar with the ongoing scandal of Britain’s predominantly Pakistani rape gangs. Yet what is also unfolding right now is a wave of brutal sexual violence committed by illegal arrivals, often asylum seekers from Afghanistan.

Take the case of Afghan national Ahmad Mulakhil, convicted last month for raping a 12-year-old girl in a park in Nuneaton, Warwickshire. Alongside one count of rape, 23-year-old Mulakhil was also found guilty of child abduction, two counts of sexual assault, and taking indecent photos of a child. He had already confessed to a charge of oral rape.

Mulakhil arrived in the UK illegally, crossing the English Channel from France in a small boat in July 2025. This being post-borders Britain, he was not detained or punished for this incursion. He was instead offered free accommodation and financial support, initially in Kent on England’s south coast, before he was relocated to Nuneaton, a quiet market town, where he was placed in social housing, at the taxpayers’ expense. Six weeks later, he approached his 12-year-old victim as she was playing on the swings in a park. His identity was confirmed when, after the attack, he went to purchase some cans of Red Bull in a nearby shop, using the preloaded debit card issued to him by the UK Home Office.

A few weeks later, just a few miles down the road in Leamington Spa, two Afghan 17-year-olds abducted a 15-year-old from a park, took her to a secluded area, and then raped her. Another Afghan illegal migrant raped a 15-year-old in broad daylight in Falkirk town center in Scotland in 2023. Sadeq Nikzad sought to defend himself by citing language barriers and “cultural differences.” These cases are barely the tip of the iceberg. You can open a newspaper on any day in Britain and expect to read about a gruesome crime committed by a small-boats migrant, more often than not from Afghanistan.

In a twisted way, the Falkirk rapist, Sadeq Nikzad, sort of had a point, even if the courts rightly rejected the notion that “cultural differences” were a reasonable defence. It is surely not for nothing that so many high-profile sex attacks in Britain are being committed by Afghans. Although data on the ethnicity and nationality of criminals are notoriously difficult to compile (made deliberately so by authorities beholden to political correctness), research by the Telegraph suggests that Afghan nationals are 20 times more likely to be convicted of a sexual offense than the average person in England and Wales. Afghans have the highest rate of sexual offending of all nationalities in the UK.

Should this really be a surprise? Of course, it would be wrong to tar every Afghan with the worst crimes imaginable. Yet it would be equally absurd to assume that Afghans shed their upbringings and cultural assumptions as soon as they arrive in Europe or on Britain’s shores.

According to the Georgetown Institute’s Women, Peace and Security Index, Afghanistan ranks last out of 181 countries on almost every measure of women’s wellbeing, from the threat of partner violence to gender-based political persecution and women’s safety in general. Since the Taliban retook power in 2021, women have been relegated to below second-class status. The Islamic Republic of Iran looks like a feminist utopia by comparison. Women are forbidden from leaving the house without a male relative, and must be fully veiled when they do so. All girls are banned from attending school and one in three is forced into a child marriage. Rape is rampant. and, while men go unpunished, female victims can be prosecuted and punished for “adultery,” including by being stoned to death. To call this misogyny “medieval” is an insult to the actual medievals.

Britons who grew up in the 1990s, 2000s or 2010s will remember the “feminist” campaigns to ban the sale of soft pornography on in supermarkets and newsagents. The Sun, once Britain’s bestselling tabloid newspaper, used to feature a bare-breasted woman on “Page Three” every day. “Lads mags”—bawdy magazines for men—would feature topless models, sex tips, and lewd anecdotes. These relatively harmless, anodyne fixtures of British public life were regularly denounced by the great and the good as “proof” that the UK had a “rape culture.”

Yet now a very real “rape culture” has been imported from Afghanistan and is tearing through Britain. It is doing so with the connivance of the state, thanks to its porous borders combined with an overly generous interpretation of who should be deemed a refugee. Meanwhile, establishment feminists are either silent at best or at worst, happily complicit in the erosion of Britain’s borders and indifferent to the now-constant abuse of women and girls this has entailed. Any suggestion that thousands of young, unattached men from the most misogynistic nation on the planet might pose a non-negligible risk to women and girls is dismissed as “divisive,” “racist” and even “fascist.”

This is not to malign everyone who arrives from Afghanistan. Not only are there many genuinely deserving of asylum from their tyrannical government (women, for instance, though they are notable for their absence among small-boats arrivals); there are also many Afghans whom the British government specifically has a duty to protect. Following the U.S.-UK withdrawal from Afghanistan in 2021, many interpreters and others who supported the British war effort were left stranded as the Taliban retook Kabul. Worse, a UK Ministry of Defence data breach led to more than 250 of their names being made public, effectively handing the Taliban a kill list of traitors. Here the case for asylum seems inarguable. Such people were placed in immediate danger of death by the rank incompetence of the British state. And so the British state has a responsibility to protect them.

But what also seems inarguable is that the British state’s primary responsibility ought to be to protect its own citizens. Instead, our “compassionate,” “open-hearted” elites are rolling out the red carpet for tens of thousands of mostly male, young, totally unvetted illegal migrants arriving at random on the southern coast. As far as the establishment is concerned, those men are the real victims deserving of the state’s charity. The women and girls that are being on a horrifyingly regular basis are treated as mere collateral damage.

Britain desperately needs a reckoning with the Afghan crime wave—and with the political leaders who have allowed and enabled it.

Indiana GOP Rep Jim Baird's wife dies of complications after car crash

Mar. 2nd, 2026 12:44 pmThree U.S. fighter planes shot down accidentally by Kuwait in friendly fire incident

Mar. 2nd, 2026 12:44 pmИз прошлого. Горбачёву - 90. Он свергнул марксистский строй

Mar. 2nd, 2026 03:38 pm

2 марта Горбачеву исполнилось 90 лет.

Из многочисленных выступлений Михаила Горбачева – раньше, в Перестройку, после и теперь, можно заключить, что этот человек до сих пор не понимает, какое великое и благое дело он совершил. То, что все считали невозможным, немыслимым. Он сверг Коммунистическую партию Советского Союза!

Вернее, он ее не сверг, а вплотную подвел к свержению, а юридически ее запретил уже Ельцин. Тогда мне говорили: ты дурак, разве ты не видишь, какая за ними стоит сила – армия, гебуха и пр. Разве такое можно повалить? Но уже в конце 80—и в начале 90-х, еще при СССР, компартия перестает существовать, её и в грош не ставят, издеваются, кто как может. Уже настал «ранний капитализм».

Сегодня Горбачеву исполняется 90 лет, и я его от души поздравляю. В нашей стране редко кого хочется поздравить. Он – среди таковых. Да, он свергнул советский строй! Фантастика! И он не понимает этого, но по факту – так получилось. И занудные выступления его слушать невозможно – раньше и теперь. Настолько они нелепые.

( Read more... )

См. также:

Разбогатевшая чернь (2015) Я хочу, чтобы у всех у них закончились деньги, чтобы они резко обеднели. Потому что наличие у них больших денег неоправданно ни с какой точки зрения и противоречит экономическим законам, они не обладают никакими интеллектуальными и иными качествами, чтобы эти деньги заработать.

Хорошее местечко на том свете (2015) Говорят, что Рай – скучнейшее место. Вообще это, как правило, очень хороший садово-парковый ансамбль, отличное садоводство и цветоводство, может, птички какие-нибудь летают, а по дорожкам перемещаются голограммы безгрешных людей и праведников.

Великобритания: некоторые аспекты доминирующей идеологии разрушения (2017) Я уже ранее писал о внезапно всплывшей на Западе темы педофилии, причем появился термин «исторические домогательства», «исторические изнасилования», когда якобы жертва утверждает, что с ней что-то делали 40-50 лет назад.

1918: приближение немцев (2018) Коммунисты – люди подлые и трусливые, они тут же пасуют перед более сильным. Вспомните, как в 1941 г. они драпали на Восток. Ну и в 1918 г. немцы запросто могли бы захватить Петроград, да и всю европейскую часть России, но не сделали этого по своим, внутренним причинам. А жаль! Вот бы хороший погром всей этой нечисти устроили! Такой, чтобы причастные к этой власти запомнили на все времена.

Физиогномика слушающих президента РФ (2018) Взглянув на этих людей, можно сразу сказать, что в ближайшее время никакого развития в этой стране не будет.

Украина. 2 марта. Киев, пригород (2022) Утро в Буче (около Киева). Сгоревшая техника российских оккупантов. У них этого железа столько, что им можно завалить весь мир.

Запад, как и прежде, боится (2022) Бои в Украине продолжаются уже неделю. Города подвергаются бомбардировкам в то время, как самый могущественный военный альянс в мире следит за этим и не торопится вводить бесполетную зону над Украиной, пишет Bloomberg. НАТО ясно дало понять, что не будет размещать в Украине войска, но отправило туда вооружение и средства защиты.

2 марта 1917 - дата отречения от престола российского императора (2023) ...приходится признать, что с уходом Николая Второго (и его гибелью) началась величайшая Катастрофа, которая продолжается до сих пор. Катастрофа с гибелью десятков миллионов людей. А главное - с изменением сущности человека. И его внешности. Того человека, что был до 1917 года, больше нет, и восстановить его невозможно.

Бесовское время чекизма (2024) Везде шатание, грязнодушие, пустота постсоветского небытия.

Germany's Strategic And Economic Vulnerability

Mar. 2nd, 2026 11:15 amSubmitted by Thomas Kolbe

A year of tariff disputes with the U.S., coupled with tighter climate regulations, has left deep marks on the German economy. The most visible consequence is a 17.8% collapse in German car exports to the United States last year. Overall exports to the U.S. fell 9.4% to €146.2 billion, while total trade volume dropped by 5%.

At the same time, China has returned as Germany’s top trading partner. Total trade rose 2.1%, but beneath the surface, tensions are severe: German exports to China fell 9.7% to €81.3 billion, while imports surged 8.8% to €170.6 billion. Germany has become a major importer of Chinese capital goods, especially in computing and electrical equipment, even overtaking Chinese companies in traditional machine-building sectors.

The diagnosis is clear: a severe structural ailment caused by years of disastrous policy frameworks. Germany is losing know-how—or has already ceded it to more dynamic global locations. The era when domestic social issues could be papered over by a strong economy is over. Germany’s social-industrial model, built on engineering excellence, social market principles, and partnership, is history.

The short-lived industrial rebound the government celebrates is merely an expensive, debt-financed stimulus. The only booming sector is defense, producing neither consumer goods nor real value for ordinary citizens. Here, lobby interests are served at the expense of future taxpayers, providing politicians with fleeting talking points for the 2026 election year.

Shifting the Strategic Matrix

Global trade shifts are restructuring the EU and Germany in fundamental ways. What once seemed manageable now reveals deep vulnerabilities. Europe’s energy dependence, worsened by political missteps, is striking: roughly 60% of its energy must be imported. This limits geopolitical maneuverability, particularly in the Middle East, and will likely force Russia’s reintegration into Europe’s energy mix over time.

Rhetoric from Brussels, including EU Foreign Affairs Chief Kaja Kallas, cannot override these realities. The idea that Europe can free itself solely through renewable expansion is naive; it risks an economic disaster reminiscent of Germany’s deindustrialization. Europe must invest heavily in available energy sources, develop domestic resources, and use existing gas and coal as a bridge, while modern nuclear technology is deployed to regain strategic energy sovereignty.

Trade policy exposes another harsh truth: Europe’s centralist economic model, coupled with its obsessive Net-Zero-Emissions approach—ignored globally—acts like abruptly slamming the brakes on a finely tuned high-speed engine. Regulatory overreach and fiscal burdens have eroded productivity, leaving citizens poorer while rivals like China exploit every advantage.

It is practically impossible to curb China’s heavily subsidized export engine through tariffs alone. Structural asymmetries are too great. China can deploy leverage at any time—for instance, restricting rare-earth exports—if Europe tries to shield its markets from Chinese dumping. U.S. deregulation and targeted investment in Germany’s key sectors, especially automotive and machinery, exacerbate the challenge. The ongoing outflow of direct investment, €60–100 billion annually, signals the historic failure of policies that have abandoned free markets in favor of moralistic central planning.

Europe must break free from its internal constraints, return to market-based principles, align more closely with the U.S., and anchor the future of European culture and economy in the Western Hemisphere. Reintegration of Russia into the energy equation is equally essential for a realistic global perspective.

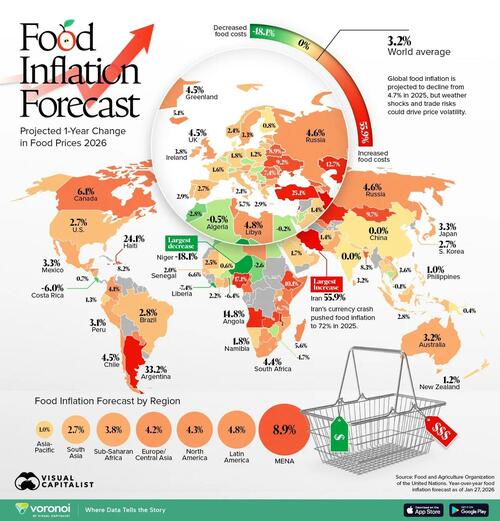

Where Food Inflation Is Expected To Hit Hardest In 2026

Mar. 2nd, 2026 10:45 amFood prices remain one of the most persistent cost pressures for households worldwide. In 2026, grocery bills are projected to rise sharply in some countries, while remaining relatively stable in others.

According to new forecasts from the UN’s Food and Agriculture Organization (FAO), food inflation will vary dramatically across 160 countries in 2026, ranging from double-digit surges in some economies to outright price declines in others.

This map, via Visual Capitalist's Dorothy Neufeld, ranks 160 countries by their projected year-over-year change in food prices, highlighting where households are likely to face the steepest increases in 2026.

The Countries Facing the Steepest Food Price Increases

Today, inflation pressures remain strongest in emerging and import-dependent economies.

Food inflation is influenced by currency movements, commodity prices, trade disruptions, and domestic supply conditions. Countries experiencing currency depreciation or ongoing economic instability tend to see sharper increases in food costs.

| Rank | Country | Year-Over-Year Food Inflation Forecast 2026 (%) |

|---|---|---|

| 1 | 🇮🇷 Iran | 55.9 |

| 2 | 🇦🇷 Argentina | 33.2 |

| 3 | 🇹🇷 Türkiye | 25.1 |

| 4 | 🇭🇹 Haiti | 24.1 |

| 5 | 🇲🇼 Malawi | 21.2 |

| 6 | 🇳🇬 Nigeria | 17.1 |

| 7 | 🇱🇧 Lebanon | 14.9 |

| 8 | 🇦🇴 Angola | 14.8 |

| 9 | 🇰🇿 Kazakhstan | 12.7 |

| 10 | 🇿🇲 Zambia | 10.8 |

| 11 | 🇪🇹 Ethiopia | 10.1 |

| 12 | 🇯🇲 Jamaica | 9.7 |

| 13 | 🇲🇳 Mongolia | 9.7 |

| 14 | 🇰🇬 Kyrgyzstan | 9.4 |

| 15 | 🇺🇦 Ukraine | 9.2 |

| 16 | 🇧🇾 Belarus | 8.9 |

| 17 | 🇸🇧 Solomon Islands | 8.8 |

| 18 | 🇧🇮 Burundi | 8.8 |

| 19 | 🇧🇩 Bangladesh | 8.3 |

| 20 | 🇩🇴 Dominican Republic | 8.2 |

| 21 | 🇬🇪 Georgia | 8.2 |

| 22 | 🇷🇴 Romania | 7.4 |

| 23 | 🇨🇻 Cabo Verde | 7.2 |

| 24 | 🇰🇼 Kuwait | 7.2 |

| 25 | 🇨🇲 Cameroon | 7.0 |

| 26 | 🇦🇿 Azerbaijan | 6.8 |

| 27 | 🇰🇪 Kenya | 6.8 |

| 28 | 🇸🇴 Somalia | 6.7 |

| 29 | 🇹🇿 Tanzania | 6.7 |

| 30 | 🇬🇲 Gambia | 6.6 |

| 31 | 🇨🇦 Canada | 6.1 |

| 32 | 🇹🇳 Tunisia | 5.7 |

| 33 | 🇰🇾 Cayman Islands | 5.7 |

| 34 | 🇲🇬 Madagascar | 5.6 |

| 35 | 🇰🇳 Saint Kitts and Nevis | 5.6 |

| 36 | 🇺🇿 Uzbekistan | 5.5 |

| 37 | 🇵🇾 Paraguay | 5.3 |

| 38 | 🇭🇳 Honduras | 5.2 |

| 39 | 🇨🇼 Curaçao | 5.1 |

| 40 | 🇮🇸 Iceland | 5.1 |

| 41 | 🇲🇰 North Macedonia | 5.0 |

| 42 | 🇷🇼 Rwanda | 4.9 |

| 43 | 🇲🇩 Moldova | 4.9 |

| 44 | 🇧🇼 Botswana | 4.8 |

| 45 | 🇱🇾 Libya | 4.8 |

| 46 | 🇱🇸 Lesotho | 4.7 |

| 47 | 🇦🇬 Antigua and Barbuda | 4.7 |

| 48 | 🇷🇺 Russia | 4.6 |

| 49 | 🇬🇱 Greenland | 4.5 |

| 50 | 🇨🇱 Chile | 4.5 |

| 51 | 🇿🇦 South Africa | 4.4 |

| 52 | 🇸🇮 Slovenia | 4.3 |

| 53 | 🇧🇹 Bhutan | 4.3 |

| 54 | 🇶🇦 Qatar | 4.2 |

| 55 | 🇬🇧 UK | 4.5 |

| 56 | 🇨🇴 Colombia | 4.1 |

| 57 | 🇲🇹 Malta | 4.0 |

| 58 | 🇹🇯 Tajikistan | 3.8 |

| 59 | 🇱🇻 Latvia | 3.8 |

| 60 | 🇮🇪 Ireland | 3.8 |

| 61 | 🇺🇬 Uganda | 3.7 |

| 62 | 🇦🇪 UAE | 3.6 |

| 63 | 🇻🇳 Viet Nam | 3.6 |

| 64 | 🇬🇭 Ghana | 3.6 |

| 65 | 🇵🇰 Pakistan | 3.5 |

| 66 | 🇧🇿 Belize | 3.5 |

| 67 | 🇪🇪 Estonia | 3.5 |

| 68 | 🇧🇬 Bulgaria | 3.4 |

| 69 | 🇦🇹 Austria | 3.4 |

| 70 | 🇧🇦 Bosnia and Herzegovina | 3.4 |

| 71 | 🇲🇽 Mexico | 3.3 |

| 72 | 🇬🇶 Equatorial Guinea | 3.3 |

| 73 | 🇯🇵 Japan | 3.3 |

| 74 | 🇬🇹 Guatemala | 3.3 |

| 75 | 🇸🇪 Sweden | 3.3 |

| 76 | 🇱🇰 Sri Lanka | 3.2 |

| 77 | 🇦🇺 Australia | 3.2 |

| 78 | 🇵🇪 Peru | 3.1 |

| 79 | 🇦🇲 Armenia | 3.1 |

| 80 | 🇲🇿 Mozambique | 3.1 |

| 81 | 🇳🇮 Nicaragua | 3.1 |

| 82 | 🇳🇱 Netherlands | 2.9 |

| 83 | 🇬🇷 Greece | 2.9 |

| 84 | 🇵🇹 Portugal | 2.9 |

| 85 | 🇧🇷 Brazil | 2.8 |

| 86 | 🇮🇩 Indonesia | 2.8 |

| 87 | 🇪🇸 Spain | 2.7 |

| 88 | 🇰🇷 South Korea | 2.7 |

| 89 | 🇱🇺 Luxembourg | 2.7 |

| 90 | 🇺🇸 U.S. | 2.7 |

| 91 | 🇱🇦 Laos | 2.6 |

| 92 | 🇮🇱 Israel | 2.6 |

| 93 | 🇲🇷 Mauritania | 2.5 |

| 94 | 🇳🇴 Norway | 2.4 |

| 95 | 🇲🇪 Montenegro | 2.4 |

| 96 | 🇧🇯 Benin | 2.4 |

| 97 | 🇬🇩 Grenada | 2.3 |

| 98 | 🇨🇮 Côte d'Ivoire | 2.2 |

| 99 | 🇦🇩 Andorra | 2.2 |

| 100 | 🇦🇼 Aruba | 2.1 |

| 101 | 🇮🇹 Italy | 2.1 |

| 102 | 🇸🇳 Senegal | 2.0 |

| 103 | 🇱🇹 Lithuania | 2.0 |

| 104 | 🇴🇲 Oman | 2.0 |

| 105 | 🇧🇧 Barbados | 2.0 |

| 106 | 🇲🇻 Maldives | 1.9 |

| 107 | 🇳🇦 Namibia | 1.8 |

| 108 | 🇩🇪 Germany | 1.8 |

| 109 | 🇲🇾 Malaysia | 1.7 |

| 110 | 🇸🇦 Saudi Arabia | 1.7 |

| 111 | 🇭🇷 Croatia | 1.6 |

| 112 | 🇫🇷 France | 1.6 |

| 113 | 🇸🇰 Slovakia | 1.6 |

| 114 | 🇹🇭 Thailand | 1.5 |

| 115 | 🇮🇶 Iraq | 1.4 |

| 116 | 🇦🇫 Afghanistan | 1.4 |

| 117 | 🇪🇨 Ecuador | 1.3 |

| 118 | 🇦🇱 Albania | 1.2 |

| 119 | 🇳🇵 Nepal | 1.2 |

| 120 | 🇳🇿 New Zealand | 1.2 |

| 121 | 🇵🇱 Poland | 1.2 |

| 122 | 🇵🇫 French Polynesia | 1.1 |

| 123 | 🇵🇭 Philippines | 1.0 |

| 124 | 🇲🇺 Mauritius | 0.9 |

| 125 | 🇹🇹 Trinidad and Tobago | 0.9 |

| 126 | 🇻🇨 Saint Vincent and the Grenadines | 0.8 |

| 127 | 🇸🇬 Singapore | 0.8 |

| 128 | 🇫🇮 Finland | 0.8 |

| 129 | 🇩🇰 Denmark | 0.7 |

| 130 | 🇸🇻 El Salvador | 0.7 |

| 131 | 🇲🇱 Mali | 0.6 |

| 132 | 🇧🇭 Bahrain | 0.5 |

| 133 | 🇵🇬 Papua New Guinea | 0.4 |

| 134 | 🇨🇾 Cyprus | 0.4 |

| 135 | 🇧🇳 Brunei Darussalam | 0.4 |

| 136 | 🇩🇲 Dominica | 0.4 |

| 137 | 🇳🇨 New Caledonia | 0.1 |

| 138 | 🇮🇳 India | 0.0 |

| 139 | 🇨🇳 China | 0.0 |

| 140 | 🇰🇭 Cambodia | -0.1 |

| 141 | 🇧🇪 Belgium | -0.1 |

| 142 | 🇪🇬 Egypt | -0.2 |

| 143 | 🇼🇸 Samoa | -0.5 |

| 144 | 🇩🇿 Algeria | -0.5 |

| 145 | 🇩🇯 Djibouti | -0.6 |

| 146 | 🇧🇫 Burkina Faso | -0.8 |

| 147 | 🇸🇨 Seychelles | -1.3 |

| 148 | 🇨🇭 Switzerland | -1.3 |

| 149 | 🇨🇿 Czechia | -1.4 |

| 150 | 🇷🇸 Serbia | -1.5 |

| 151 | 🇯🇴 Jordan | -1.7 |

| 152 | 🇿🇼 Zimbabwe | -1.7 |

| 153 | 🇭🇺 Hungary | -2.2 |

| 154 | 🇹🇩 Chad | -2.6 |

| 155 | 🇲🇦 Morocco | -2.8 |

| 156 | 🇫🇯 Fiji | -3.5 |

| 157 | 🇨🇷 Costa Rica | -6.0 |

| 158 | 🇹🇬 Togo | -6.4 |

| 159 | 🇱🇷 Liberia | -7.4 |

| 160 | 🇳🇪 Niger | -18.1 |

At the top of the ranking is Iran, where food prices are forecast to rise 55.9% year-over-year.

Iran’s currency depreciation and prolonged inflationary pressures have already pushed food inflation to extreme levels in recent years. The 2026 forecast suggests those pressures may persist.

Several Sub-Saharan African economies—including Nigeria (17.1%), Angola (14.8%), Zambia (10.8%), and Ethiopia (10.1%)—also rank among the highest. In many of these countries, food inflation is closely tied to currency volatility, import dependency, and supply-side disruptions.

Regional Differences in Food Inflation

While the global average is projected at 3.2%, the regional breakdown shows stark differences in how food prices are expected to evolve in 2026.

| Region | Year-Over-Year Food Inflation Forecast 2026 (%) |

|---|---|

| Middle East & North Africa (MENA) | 8.9 |

| Latin America | 4.8 |

| North America | 4.3 |

| Europe & Central Asia | 4.2 |

| Sub-Saharan Africa | 3.8 |

| South Asia | 2.7 |

| Asia-Pacific | 1.0 |

The Middle East and North Africa region stands out, with nearly triple the global average.

North America sits around the middle of the pack, with food prices projected to rise 4.3%. In the U.S., prices are expected to increase 2.7%, while in Canada, prices could climb at more than twice that pace.

Meanwhile, much of Asia-Pacific is projected to see relatively modest food price growth.

While global food inflation is expected to fall in the single digits in 2026, the regional picture tells a far more uneven story. For millions of households in high-inflation economies, grocery bills may remain one of the most persistent economic pressures in the year ahead.

To learn more about this topic, check out this graphic on the U.S. cities with the highest grocery costs.

включил финкеля(который рав из геров)

Mar. 2nd, 2026 11:12 amмы, великие, гениальные, высокотехнологичные, перемогаем, вся американская махина для нас каштаны из огня носят, шиитам капец.

так хочется в это поверить! только жесткая многолетняя дисциплина ума не позволяет впасть в иллюзию.

новое вторжение в ливан, мобилзация 100 т. резервистов

Mar. 2nd, 2026 10:37 amPoland Plans Social Media Ban For Under-15s

Mar. 2nd, 2026 09:15 amThree months after Australia banned minors under the age of 16 from accessing social media, Poland is preparing to do the same thing.

A bill is currently being prepared by the largest party in Poland's ruling Civic Coalition Party that would prohibit children under the age of 15 from using social media platforms, and would require tech companies to verify users' ages.

Education Minister Barbara Nowacka laid out the plan on Friday, which include fines of up to 6% of the worldwide (global) revenue of social media companies if their services remain accessible to under-15s.

"We need to limit access to social media for children under 15. At the same time, we need to work on mental health and raise awareness among children, parents, and the entire Polish society about the dangers of social media," Nowacka said.

If sped through legislation, Poland's bill could take effect as early as 2027, however the coalition hasn't fully signed off yet, and it will undoubtedly face legal pushback from US tech giants.

As the Epoch Times notes further, on Dec. 10, Australia became the first country to impose nationwide restrictions on minors accessing social media, banning those under 16 from a dozen platforms.

The restrictions were brought in amid concerns over mental health, online harms, and screen addiction affecting Australian children.

Poland is the latest country in the European Union to say it was planning to introduce a ban or some other form of restriction, with other member states similarly citing concerns over children’s mental health.

In France, legislation is moving through parliament to ban children younger than age 15 from accessing social media platforms. Denmark and Slovenia are likewise looking at bans for under-15s.

Spain will follow Australia in banning social media for minors under age 16.

Portugal is taking a different approach. Rather than introducing an outright ban on children under a certain age from accessing social media, it aims to require explicit parental consent for children aged 13 to 16 to access the platforms.

Other countries around the world are making similar plans, including Malaysia, which says it will ban social media accounts for children younger than age 16 this year.

‘Age-Gating’ Social Media

British Prime Minister Keir Starmer announced a series of new proposals earlier this month aimed at protecting young people from social media addiction, including a proposed ban for under-16s, subject to a public consultation.

Some measures by the UK and the EU to curb online harms have led to tensions with the United States, home of many big tech companies, around issues of free speech and regulatory overreach.

Privacy and free speech advocates, such as UK-based Open Rights Group, say that a social media ban for under-16s would be an ineffective response to online harms.

The Open Rights Group says it would lead to “age-gating” across all social media platforms, requiring users to prove their age.

“Protecting children online should not mean building a surveillance infrastructure for everyone,” Open Rights Group spokesman James Baker said.

“We need regulation that puts users back in control, not policies that force people to trade their privacy and voice for access to modern life.”

Rachel Roberts and Reuters contributed to this report.

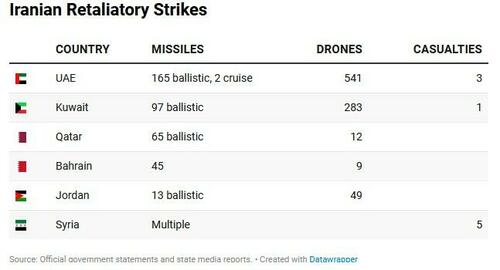

Gulf States Say They've Shot Down More Than 1,500 Iranian Missiles, Drones

Mar. 2nd, 2026 08:30 amAuthored by John Haughey via The Epoch Times (emphasis ours),

Five Persian Gulf nations that host U.S. military installations claim they have collectively shot down more than 1,500 Iranian missiles and drones since the United States and Israel launched their joint attack at 9:45 a.m. Tehran time on Feb. 28.

The United Arab Emirates (UAE)—whose forces have battled Tehran-backed Houthis in Yemen—has borne the brunt of the Iranian attacks.

While numbers are fluid and reported timelines varied, as of 6 p.m. ET on March 1—2:30 a.m. March 2 in Iran—the UAE Ministry of Defense reported it had knocked down 165 ballistic missiles, two cruise missiles, and more than 540 drones.

Debris from destroyed projectiles crashed into several Abu Dhabi residential neighborhoods, killing at least one civilian, the ministry reported, also stating that at least three people have been killed in Iranian strikes in UAE.

The attacks are “a blatant violation of national sovereignty and international law,” the ministry said in a statement, warning UAE would “take all necessary measures to protect its territory, citizens and residents, and to safeguard its sovereignty, security and stability.”

Bahrain’s military said March 1 that its air defense systems had intercepted at least 45 missiles and nine drones, with the U.S. Navy’s Fifth Fleet headquarters in Manama and a British navy base specifically targeted.

No casualties were reported at the U.S. and UK bases. British forces reported shooting down a drone in Manama. UK Prime Minister Keir Starmer on March 1 said the British have accepted a U.S, request to use its bases across the Middle East, including its large air base in Cyprus, to strike Iranian missile launchers.

Kuwait’s military reported it shot down nearly 100 missiles and almost 300 drones during the first 24 to 36 hours of the conflict.

The Iranian attacks focused on Ali Al-Salem Air Base where American and other international forces are stationed. Drones also struck Kuwait International Airport on Feb. 28, causing minor injuries and “limited damage.”

Italian Deputy Prime Minister Antonio Tajani, however, told Italian news outlet ANSA that a Kuwait International Airport runway sustained extensive damage.

Qatar’s Ministry of Defense said it shot down 65 ballistic missiles and at least 12 drones fired at it from Iran. “We possess the full ability to protect the country and fend off any external threat,” the Qatari ministry said, adding Qatar is “secure and stable,” although the country’s air space has been temporary closed to commercial traffic.

Two ballistic missiles struck the U.S. Al-Udeid Air Base causing no reported casualties and little damage, while a drone strike disabled an early warning radar installation.

Most U.S. Air Force airmen and aircraft normally stationed at Al-Udeid, including KC-135s in-flight refueling jets, C-17A Globemaster transports, and C-130 Hercules airlift transports, were moved to other bases in the Mediterranean and Diego Garcia in the Indian Ocean in the days preceding the attack.

Jordan’s armed forces reported March 1 that they had intercepted 13 ballistic missiles and knocked down nearly 50 drones targeting U.S. forces at Muwaffaq Salti Air Base.

“The armed forces engaged 49 drones and ballistic missiles targeting Jordanian territory today,” the Jordanian armed forces said in a statement, adding “13 ballistic missiles were successfully intercepted by Jordanian air defense systems, while drones were shot down.”

An undetermined number of missile and drone attacks have also been reported in Saudi Arabia, Iraq, and Syria.

U.S. forces at Harir Air Base in Erbil in northern Iraq’s Kurdistan area were attacked with missiles and drones with no casualties and little damage reported. British forces report they knocked down several missiles in Iraq.